-

Module 2.0 How to be Successful in this Course

-

Module 2.1 Introduction to Natural Gas

-

Module 2.2 The Natural Gas Industry in British Columbia

- Overview

- Learning Outcomes

- Natural Gas Science – The Simple Version

- Natural Gas Science – Chemistry

- Natural Gas Science – Physics

- Natural Gas Science – Units of Measurement

- Natural Gas Science – Geology

- Natural Gas Resources and Uses

- Oversight of the Natural Gas Industry

- Understanding Land Rights and Natural Gas

- Energy and the Future

-

Module 2.3 Upstream – Well Site Selection, Preparation and Drilling, Completion, Production, Water Recycling, and Reclamation

- Learning Outcomes

- The Upstream Sector – Extraction and Processing

- The Upstream Sector – Exploration and Site Selection

- The Upstream Sector – Preparation and Drilling

- The Upstream Sector – Completion

- The Upstream Sector – Production

- The Upstream Sector – Water Recycling

- The Upstream Sector – Reclamation

- Upstream Companies and Jobs in British Columbia – Companies

- Upstream Companies and Jobs in British Columbia – Industry Associations

- Upstream Companies and Jobs in British Columbia – Professional Associations

- New Vocabulary

-

Module 2.4 Midstream – Transportation, Processing, Refining

- Learning Outcomes

- The Midstream Sector

- The Midstream Sector – Processing Natural Gas

- The Midstream Sector – Liquefied Natural Gas

- The Midstream Sector – An Emerging Industry

- The Midstream Sector – Processing LNG

- The Midstream Sector – Proposed LNG Projects in British Columbia

- Transportation

- Midstream Companies and Jobs in British Columbia

-

Module 2.5 Downstream – Refining and Markets

-

Module 2.6 Health and Wellness in the Natural Gas Industry

-

Module 2.7 Safety

-

Module 2.8 Terminology and Communication

-

Module 2.9 Jobs and Careers

- Learning Outcomes

- Industry Outlook

- Technology is Changing Workforce and Skills

- Employment in the Natural Gas Industry

- Employment in the Natural Gas Industry – Types of Employment

- Employment in the Natural Gas Industry – Range of Jobs

- Employment in the Natural Gas Industry – High Demand Jobs and Occupations

- Occupational Education and Training

-

Module 3.0 How to be a Valued Employee

-

Module 3.1 Identifying Interests and Skills

-

Module 3.2 Looking for Employment in Natural Gas

-

Module 3.3 Applying for Employment in Natural Gas

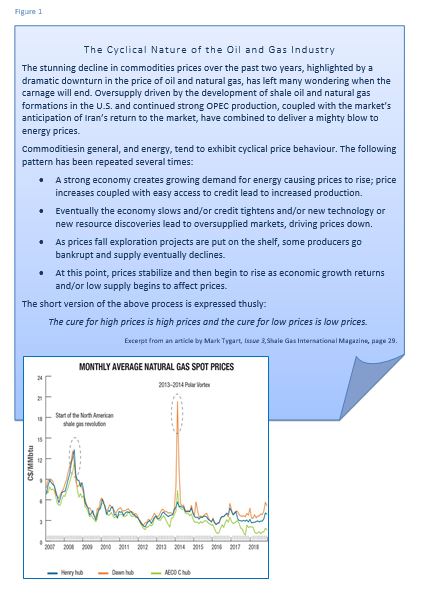

The long-term economic outlook for the natural gas industry is positive, driven by strong global demand for energy and consumer preferences for cleaner, more efficient energy sources in residential, commercial and industrial markets.

However, the industry is also cyclical, meaning that when the economy is strong (growing) conditions are good and when the economy is weak (not growing or even contracting) so does the natural gas industry.

Complex issues like COVID-19, and more simple factors like weather, the time of year, and changes from season to season can impact activity in the natural gas industry.

Over the past decade, the natural gas industry in British Columbia has enjoyed rapid growth.

Although the industry experiences downturns from time to time; growth in the BC natural gas industry is expected to continue for the longer term, as natural gas prices begin to climb back to levels that are more normal. Employment opportunities are forecasted to pick up as natural gas commodity prices and demand increases.

Developing British Columbia’s LNG industry is anticipated to grow Canada’s economy by an average of $7.4 billion per year over the next 30 years, according to a February 2016 Conference Board of Canada report

British Columbia’s stake in the natural gas industry has grown substantially over the last decade; industry investment almost quadrupled between 2000 and 2010, increasing from $1.8 billion to $7.1 billion

- Capital expenditures in the BC natural gas sector were $3.5 billion in 2018 and $3.2 billion in 2019, however, capital expenditures will increase in the near term as LNG Canada construction activities increase.

- British Columbia is predicted to lead the country in attracting natural gas investment from 2012 to 2035, garnering $181 billion seconded by Alberta drawing in $154 billion, according to a 2014 report by the Conference Board of Canada.

- These labour market projections in 2012 for LNG projects were based on a scenario of three LNG facilities constructed and in operations by 2020. Although there are no medium or large-scale LNG facilities currently in operation, they are still expected to proceed, although which ones and how many has not yet been determined. However, even if only one or two projects move ahead, a large number of workers will be required, and they will be needed quickly. Northern BC has a very small labour force (three percent of provincial total) and will need to attract a substantial number of workers to fulfill construction and operations requirements.

- In a 2016 analysis, Petro LMI forecasts employment of 5,240 workers for the on-site construction of an LNG facility and 3,300 for pipeline construction at the peak of activity in year three. This projection is based on construction of a large two train plant and pipeline.

- LNG Canada and TC Energy are expecting that approximately between 6,500 and 10,000 workers will be employed during the construction of the plant and pipelines and an additional 325-500 permanent jobs will be created to operate the facility in Kitimat. Once constructed the operations are expected to create another 10,800 to 15,200 indirect jobs, nearly double the indirect jobs created during construction.

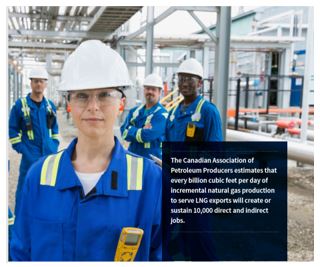

The Canadian Association of Petroleum Producers (CAPP) estimates that every billion cubic feet per day of incremental natural gas production to serve LNG exports will create or sustain 10,000 direct and indirect jobs. Construction of the two processing trains associated with the first phase of LNG Canada’s export facility in Kitimat will require 3.5-4 billion cubic feet per day (Bcf/d) of incremental natural gas production. A decision for further expansion to LNG Canada’s facility is expected before 2025.

The Canadian Association of Petroleum Producers (CAPP) estimates that every billion cubic feet per day of incremental natural gas production to serve LNG exports will create or sustain 10,000 direct and indirect jobs. Construction of the two processing trains associated with the first phase of LNG Canada’s export facility in Kitimat will require 3.5-4 billion cubic feet per day (Bcf/d) of incremental natural gas production. A decision for further expansion to LNG Canada’s facility is expected before 2025.

1A Changing Tide: British Columbia’s Emerging Liquefied Natural Gas Industry

The Conference Board of Canada, 2016, Document Highlights.

2Trade and Invest British Columbia 2014. http://www.britishcolumbia.ca/invest/industry-sectors/natural-gas.aspx.

3LNG plants normally use two trains of compressors running in parallel. This design costs more, but it provides better balanced production. Running two trains also eliminates the risk of shutdown in case one of the trains requires unplanned service operations. A larger LNG plant would use four trains.

4LNG Canada, https://www.lngcanada.ca/opportunities/ and https://www.coastalgaslink.com/employment/